At BBVA we started exploring and practicing with APIs long before PSD2 emerged. If they had asked us then about the future of Open Banking (the name did not exist then) our answer would have been substantially different than if they had asked us now in 2024. The truth is that on both occasions we would have pointed out the huge potential of APIs and how they will help society achieve the future.

APIs helped banks to operationalize Open Banking, the first step for sharing financial data, and Open Finance, an expanded scope of the products shared by Open Banking. and will they eventually push forward reaching Open Data?

In this non-exhaustive article, I share with you a brief explanation of integrated finance, its status, how banks think about it, and what is required—always colored with my personal opinion and my experience coming from a bank that is a reference in embedded finance.

What’s Embedded Finance?

Embedded finance is the integration of financial services into non-financial offerings and allows banks to offer financial products to clients when they need it and wherever they are.

Good, but is it that innovative? not precisely. Just remember how you could, for decades, apply for a car loan at a dealership. The very same principle exists now but fully digital powered by open banking bringing together the contextuality with a boost in convenience and immediacy for end customers.

Did banks magically create embedded finance? Truth be told, the trigger was a triangle formed by new technologies, changes in customer behavior thanks to those new technologies, and regulations that catch up with new customer behavior.

Nowadays digitalization covers a big part of our lives, by using our PCs, tablets, mobile phones, or other connected devices (IoT) we leave a digital footprint of needs, wishes, interests, likes, and dislikes. If banks or any other business can use that trace data appropriately, they will be able to offer services where and when clients need them.

Customers have embraced the change and are getting used to and even demand contextual financial services, even invisible or embedded in those journeys that may require a payment, a consultation from our financial data, exchange currency, investment, or financing a product or a service.

This trend is unstoppable, and that is why regulations arise to ensure customers keep control of their data, parties accessing their data meet security and privacy requirements and a true level playing field exists.

Embedded Finance is Growing Globally

Embedded finance is spreading throughout the world at the same pace as its regulation is establishing itself and we can distinguish different speeds at different regions:

The Head of the Pack: Asia

Asia is the leading market in embedded finance. Having a well-balanced triangle formed by the technology adoption by companies, the digital habits of the population to consume financial services, and the regulations powering them. This situation favors all banks’ active participation in the embedded finance ecosystem. Is common to see these banks with a large and ever-increasing offering of APIs.

The Unorthodox: USA

In the USA, embedded finance developed following a practical market-driven approach, letting the real customer demand call for the evolution of data-sharing capabilities. This situation favored the speed of reaction as it was not needed to wait for the regulators but also created the uncertainty of security on data exchange, customers’ data rights, etc. Thus it seems that the situation in the USA is at a turning point where some institutions and fintech firms have voluntarily adopted Open Banking principles and there’s a growing acknowledgment that an incoming regulation will be key for the future of open banking and embedded finance.

The Regulated: Europe & Australia

Europe is an example of development through regulation first. PSD2 forced all banks to invest and offer APIs regardless of their appetite to do so. From there several banks started to explore embedded finance leveraging on the knowledge and effort acquired by complying with the regulation.

The future PSR intends to improve and extend the effects of PSD2 and, moreover, the new FIDA regulation (Financial Data Access Framework), which increases the scope of customer data that can be shared beyond PSD2, leaving room for “Open Finance.”

Australia is a step ahead and pioneering in the use of data, facing the open data challenge with the CDR legislation (Customer Data Right) that embraces open finance and access to data from other sectors such as energy and telecommunications.

The Newcomers:

Some regions such as South America, Africa, and Asia Pacific are exploring the use of Open banking and embedded finance, they are not monolithically regulated and combine countries where the regulation is speedily driving the business as Brazil or Nigeria with others that have not started to think about Open Banking. These widely unbanked regions are the ones that can better benefit from Open Banking and Embedded finance and use them, for example, to make financial services accessible to remote and rural areas.

We have seen that regulation is a key factor in spreading and consolidating open banking and embedded finance around the world. In these data-sharing businesses, the regulation is critical to create legal certainty and protection for both customers and participants (banks, enablers, partners, etc.).

How Do Banks Feel About Embedded Finance?

Is it a threat? As it happened with regulatory Open Banking initiatives the initial feeling of the banks for Embedded Finance was the fear of losing the customer relationship and somehow getting disintermediated from the banking business. For businesses traditionally focused on customer relationships this was a tough pill to swallow.

Is it an opportunity? once the fear is overcome, though, the effect is quite the opposite of losing the customer relationship. Through embedded finance banks are not losing the relationship with customers, but rather bringing financial services to the customers exactly where they carry out their daily activities through a channel created by a third party. In summary, reaching customers outside the bank’s premises. Basically, the relationship with the client is through the partners, but the client remains the bank’s.

And even better, embedded finance also influences the customer acquiring cost. First, customer acquisition is much more expensive for banks than for e-commerce portals, travel websites, or even telcos, and second, one new customer directly acquired through the bank’s web or app costs much more than acquiring them through the bank’s partner ecosystems.

In fact, according to the conclusions drawn by the report ‘Embedded finance: Creating the everywhere, everyday bank’ from IBM, financial institutions are increasingly investing in the ‘platform economy’, and 20% of them already offer embedded finance solutions to bring financial services to consumers using these digital environments. Furthermore, 70% of bank executives affirm that embedded finance is essential or complements their business strategy.

Notice that embedded finance has to be in fact ‘embedded’ in the system of a third party thus the model requires the bank to agree with partners. In fact, establishing alliances is the main value that embedded finance brings to the sector. It’s a perfect match between a company that wants to offer excellent financial solutions to their customers without becoming a bank and on the other hand, a bank that wants to attract customers of this company, who probably would not visit the bank’s website otherwise.

What Does a Bank Need for Providing Embedded Finance?

Of course, a platform for offering APIs, API portals, and gateway APIs, but is there anything else needed that doesn’t seem obvious? Sure, take note:

- Profound changes in the culture and organization of the bank; Keep in mind that banks are used to products and customers being offered on their own premises (physical or digital ones) so security, processes, scorings, testing, etc. work perfectly under those conditions…but no so quite when the financial service is being called from outside the bank and used by unknown customers. In our experience, embedded finance will not be a reality in any bank without a commitment at all levels in the organization.

- Clear strategy: decide the segment you want to specialize in yourself, retail, enterprise, or both and the sectors to be served. How many resources you can employ will determine the width of the offering that you can afford. Once this is decided, understand which partners you want to work with and what value can the partnership jointly offer to end customers.

Bear in mind that it’s not possible to offer the whole bank services APIfied, so it’s always a good exercise to prioritize what open banking services to offer first. A good way to prioritize is by conducting sales discovery processes with potential partners and understanding their needs.

- Understand that monetizing Embedded finance does not always mean direct fees coming from APIS usage, as a bank is important to acquire customers or increase the selling of financial products and that can be achieved through APIs.

- Reaching and consolidating a partnership is not easy, relying on market aggregators, Core systems and ERPs will allow reaching a bigger mass of partners in a shorter time. It improves the end customers’ experience as they will have access to financial services embedded within their everyday systems and simplifies integrating servicing, and traceability from the bank’s perspective.

What About the Embedded Finance Offering?

Looking at the offerings of the main banks offering embedded finance there are some safe bets and some interesting products that we can see growing each year.

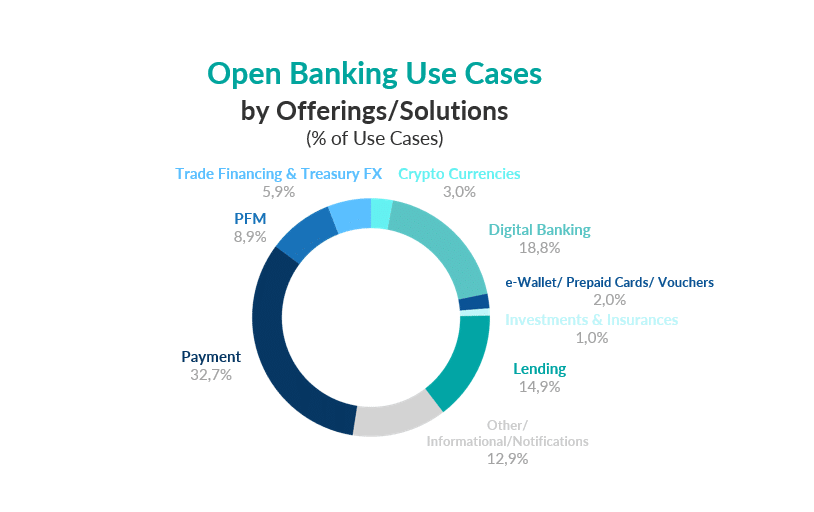

Figure 1 Distribution of use cases published by main banks offering embedded finance 2023 (Own sources)

Payments and PFM, as the main beneficiary of the regulated Open Banking, are always a safe bet, most of the use cases identified in the market fall into these categories. We see payments made directly from the bank account or “pay-by-bank” as a trending product right now. Also, the VRPs (Variable recurring payments) is an intriguing product promoted in the UK, that can change the payment methods from customers, challenging cards and debit mandates at the same time.

Loan products are on the rise, they are not the first option for banks starting out with integrated finance, but they are an obvious choice for the high demand for the product. The possibility for the client to request financing at the same time and place in which they buy a car, a mobile phone, their PlayStation, or even the mortgage for their new house, is truly powerful.

Notifications are another feature that we can see as providing value in the market. Mainly for SMEs (Small and Medium Enterprises) or Sole traders, the possibility of being notified about payments or charges allows them to reconcile and ensure business continuity.

Treasury services, if you are covering the SMEs and enterprise segment, this is a sure choice. We can see high demand from companies looking forward an automatization and digitalization of their daily operations and the APIs can help that task with an immediate result.

Hidden in all these categories appear data validation services, which will make it possible to build other services. For example, when utilities companies can validate the accounts of their new clients before sending the bill for the services avoiding many errors and inconveniences for both the user and the company.

And of course, the identity verification which allows online registration of individual clients and business clients, where everything becomes a little more complex because we have to validate the powers of the people who are operating.

What are My Two Cents on Embedded Finance:

Embedded finance is here to stay, and it will only grow in scope and importance as soon as banks realize their benefits and the different regulations all over the world get leveled.

This is a cultural change, the behavior of customers about their finances is evolving at a fast pace and that demands for banks to gradually shift their way of interacting with customers. Banks will still exist, and customers will still demand financial services, the difference is in where that demand comes from.

So this change for banks should be an occupation instead of a preoccupation and each one of them needs to prepare themselves starting from the mindset of the organization, a clear strategy on segments to be served, partners to pursue and the services to be provided.

Read more API articles:

APIs: The Secret Sauce Behind Financial Innovation

Expert in Open Banking, Embedded Finance, Consumer Finance, and Retail Banking. Broad and extensive international experience in Project and Program Management, Business Consulting, Application Architecture, Operations, and now Strategy. I’ve worked with large national and international Financial Institutions in Spain, México, Andorra, and China. Coming from a heavy background in technology and banking I’m a convinced and enthusiastic supporter of Open Banking and Embedded Finance as the next logical steps for achieving a banking without borders.