In the rapidly evolving digital landscape, the integration of artificial intelligence (AI) capabilities into banking operations has become imperative for financial institutions to stay competitive and deliver superior customer experiences. AI in banking represents a comprehensive and interconnected network of financial services, applications, and technologies that leverage AI to enhance and personalize banking experiences. It involves the integration of AI-driven solutions and tools into various aspects of the banking ecosystem, including customer interactions, back-end operations, risk management, and decision-making processes.

AI in banking represents the use of AI algorithms and technologies to analyze vast amounts of data, extract meaningful insights, automate processes, and provide intelligent and tailored recommendations to customers. These ecosystems aim to leverage the power of AI to optimize efficiency, improve customer satisfaction, and drive innovation within the financial industry.

How can banks transform to become AI banks?

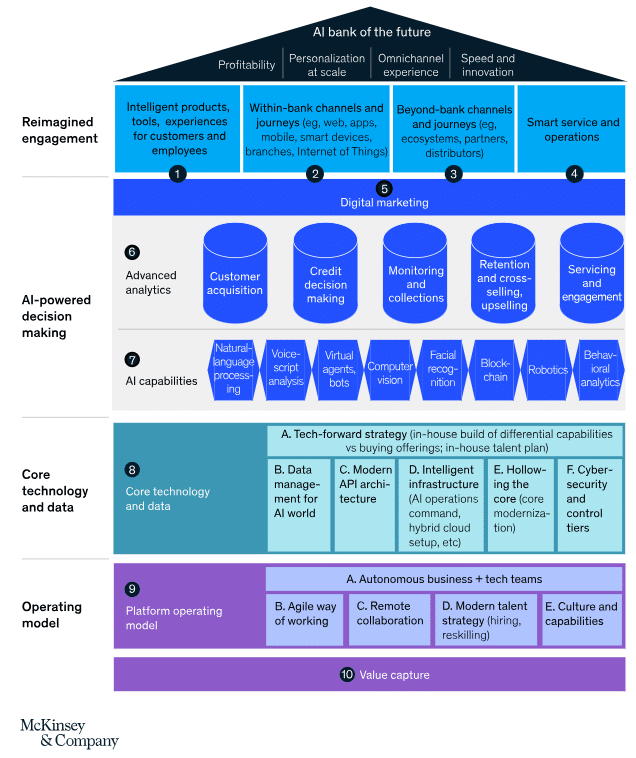

According to McKisney, banks must take a holistic approach to overcome the challenges involving AI in banking. This means transforming capabilities across the following four layers (see picture below):

- Engagement layer: Customers expect their bank to know their context and needs, no matter where they interact with the bank, and to enable a frictionless and enhanced experience.

- AI-powered decisioning layer across domains within the bank: AI techniques can produce significantly better outcomes, enhanced experience for customers, actionable insights for employees, and stronger risk management.

- Core technology and data layer: this layer accommodates increasing use of the cloud reduction of legacy technology while deploying AI capabilities across the organization.

- Operating model layer: a new operating model is needed, so that the bank can achieve the agility and speed required to unleash value across the other layers.

Benefits of AI in Banking

AI in banking offers several key benefits for financial institutions:

- Enhanced Customer Experience: By leveraging AI in banking can provide personalized and tailored experiences to their customers. Through data analysis and machine learning algorithms, banks can gain a deep understanding of customer preferences and offer customized products and services. Personalized recommendations, proactive assistance, and real-time support contribute to a superior customer experience, fostering loyalty and customer satisfaction.

- Operational Efficiency: AI-powered automation and intelligent algorithms streamline banking operations, reducing manual efforts and errors. Repetitive tasks, such as data entry, document processing, and customer support, can be automated, freeing up resources for more value-added activities. This improves operational efficiency, reduces costs, and enables banks to deliver services more efficiently.

- Risk Management and Fraud Detection: AI algorithms can analyze large volumes of data in real time, helping banks identify potential risks and fraudulent activities. By monitoring transaction patterns, behavioral data, and external factors, AI-powered systems can detect anomalies and flag potential risks. This enhances risk management capabilities, enables proactive measures, and protects both banks and customers from financial losses.

- Data-driven Insights: AI-powered analytics enable banks to gain valuable insights from vast amounts of customer data. By leveraging AI algorithms, banks can extract meaningful patterns, identify trends, and make data-driven decisions. This empowers banks to deliver personalized offerings, optimize product portfolios, and improve decision-making processes.

The Role of APIs in Powering AI in Banking

APIs (Application Programming Interfaces) play a critical role in AI-powered digital banking ecosystems. APIs facilitate the seamless integration of AI technologies into existing banking systems and enable the exchange of data and functionalities between different applications and platforms. APIs allow banks to connect AI-powered solutions with customer-facing applications, back-end systems, and third-party services.

APIs enable banks to access and leverage AI capabilities from external providers, including AI models, natural language processing, and machine learning algorithms. This accelerates the adoption of AI technologies and enables banks to innovate rapidly without building everything from scratch. By utilizing APIs, banks can unlock the full potential of AI and deliver enhanced services and experiences to their customers.

Furthermore, APIs also enable banks to collaborate and form partnerships with FinTech companies and other technology providers. This collaboration allows banks to leverage the expertise and innovations of these external partners and enhance their AI-powered digital banking ecosystem. APIs facilitate the secure and efficient exchange of data, enabling seamless integration and interoperability across different systems and platforms.

AI in Banking Use Cases

AI in banking encompasses a range of use cases that revolutionize the way banks operate and interact with customers. Let’s explore some key use cases in more detail:

Data Analytics and Insights

AI algorithms analyze customer data, transaction patterns, financial behavior, and other relevant information to generate valuable insights. This analysis enables banks to offer personalized services, detect fraud, identify trends, and improve decision-making processes. By leveraging AI-driven data analytics, banks gain a deeper understanding of their customers’ needs, preferences, and financial goals.

Personalized Services

AI in banking enables the delivery of personalized services tailored to individual customer needs and preferences. By leveraging AI technologies, banks can offer customized product recommendations, personalized financial advice, and tailored notifications. This level of personalization enhances the overall customer experience, fosters customer loyalty, and drives customer satisfaction.

Intelligent Automation

AI-powered automation plays a vital role in digital banking ecosystems. Repetitive and manual tasks, such as data entry, document processing, and customer support, can be automated using AI technologies like robotic process automation (RPA) and natural language processing (NLP). This automation streamlines operations, reduces errors, and improves overall efficiency, allowing bank employees to focus on more value-added activities.

Risk Management and Fraud Detection

AI algorithms are deployed to identify and analyze potential risks and fraudulent activities in real time. By monitoring transaction patterns, behavioral data, and external factors, AI-powered systems can detect suspicious activities, flag potential risks, and take proactive measures to mitigate them. This enhances risk management capabilities, protects customers’ financial assets, and safeguards the reputation of the bank.

Virtual Assistants and Chatbots

AI-powered virtual assistants and chatbots are integrated into digital banking ecosystems to provide instant and efficient customer support. These intelligent chatbots can handle customer queries, assist with account inquiries, provide personalized recommendations, and guide customers through various banking processes. By leveraging AI technologies, banks can deliver a seamless and interactive customer experience, ensuring round-the-clock support and efficient query resolution.

Advanced Security Measures

AI technologies contribute to enhanced security within digital banking ecosystems. AI algorithms can analyze user behavior, biometrics, and transactional data to detect anomalies and potential security breaches. This enables banks to implement multi-factor authentication, biometric identification, and advanced fraud detection mechanisms. By leveraging AI-driven security measures, banks can protect customer data, mitigate cybersecurity risks, and enhance overall trust and confidence in digital banking services.

AI in Banking Roadmap: A Generic Approach

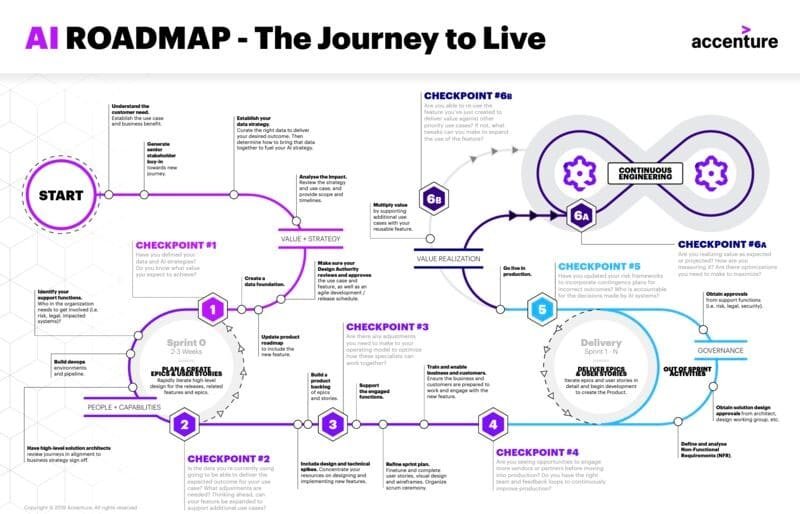

To successfully adopt AI within banking operations, banks should follow a structured roadmap. While the specifics may vary for each organization, here is a generic approach to guide the AI adoption process:

- Define Objectives: Clearly articulate the objectives and expected outcomes of integrating AI into banking operations. Identify specific areas where AI can add value and align them with the bank’s strategic goals.

- Data Infrastructure and Governance: Establish a robust data infrastructure and ensure data governance practices are in place. Collect and organize relevant data, ensure data quality, and implement security measures to protect sensitive customer information.

- Talent Acquisition and Development: Build a team of AI experts and data scientists who can develop and deploy AI solutions. Invest in training programs to upskill existing employees and foster a culture of innovation and continuous learning.

- Pilot Projects and Proof of Concept: Start with small-scale pilot projects to test the feasibility and effectiveness of AI solutions. Evaluate the results and iterate on the models to improve their performance.

- Scalability and Integration: Once pilot projects prove successful, scale up the implementation of AI solutions across relevant departments and business functions. Integrate AI seamlessly into existing systems and processes to maximize its impact.

- Continuous Monitoring and Improvement: Regularly monitor and evaluate the performance of AI models. Incorporate user feedback and data-driven insights to refine and improve AI solutions over time.

By designing a roadmap with these points in mind, banks can successfully integrate AI into their operations, optimize efficiency, enhance customer experiences, and drive innovation within the banking industry. The following picture shows an approach from Accenture proposed in the report “Scaling enterprise AI for business value”.

The ROI of AI in Banking

The return on investment (ROI) of AI in banking extends beyond financial metrics. It encompasses improved customer satisfaction, reduced risks, enhanced decision-making capabilities, and operational efficiency. Banks that strategically invest in AI technologies and leverage data-driven insights can unlock these benefits, gain a competitive advantage, and drive sustainable growth in the digital era.

Determining the ROI for AI implementation in the banking sector involves assessing the financial impact and benefits derived from AI-powered initiatives. Here’s a framework to calculate ROI for AI in the banking sector:

- Identify Costs: Begin by identifying the costs associated with AI implementation, including software and hardware investments, data infrastructure, talent acquisition and development, training programs, and any necessary infrastructure upgrades. Consider both initial investment costs and ongoing operational expenses.

- Define Key Performance Indicators (KPIs): Establish KPIs that align with the objectives of AI implementation in banking. These KPIs could include cost reduction, improved operational efficiency, enhanced customer satisfaction, fraud detection rates, risk mitigation, and revenue growth. Quantify these KPIs to measure their impact on the overall ROI.

- Measure Financial Benefits: Evaluate the financial benefits generated by AI implementation. This could involve assessing cost savings resulting from process automation, reduction in manual errors, improved operational efficiency, and increased productivity. Consider factors such as reduced staffing costs, streamlined processes, and faster decision-making capabilities.

- Quantify Customer Experience Improvements: AI implementation can significantly impact customer experiences in the banking sector. Quantify improvements in customer satisfaction, retention rates, cross-selling opportunities, and revenue growth from personalized recommendations and tailored services.

- Consider Risk Reduction and Fraud Detection: Calculate the financial impact of AI-driven risk mitigation and fraud detection measures. Assess the reduction in financial losses resulting from improved fraud detection rates, early risk identification, and regulatory compliance.

- Calculate ROI: To calculate the ROI, subtract the total costs associated with AI implementation from the total financial benefits obtained. Divide the resulting value by the total costs and multiply by 100 to express the ROI as a percentage.

- Continuous Monitoring and Adjustment: Monitor and review the calculated ROI periodically. As AI implementation progresses and new data becomes available, reassess the ROI and adjust account for changing circumstances, evolving KPIs, and emerging trends.

It is essential to note that ROI calculations for AI in banking should extend beyond financial metrics. Consider qualitative factors such as improved decision-making, increased agility, and competitive advantages gained through AI implementation. A comprehensive ROI assessment should encompass a holistic view of the benefits derived from AI across various dimensions of banking operations.

By systematically calculating and evaluating the ROI of AI in the banking sector, financial institutions can make informed decisions, prioritize AI initiatives, allocate resources effectively, and drive sustainable growth in the digital era.

Conclusion

As the banking industry continues to evolve in the digital age, embracing AI has become crucial for banks to thrive in a competitive landscape. AI offers transformative capabilities that can revolutionize processes, enhance customer experiences, and drive operational efficiency. By following a structured adoption roadmap, banks can successfully integrate AI into their operations and unlock the benefits of this game-changing technology. The ROI of AI in banking is substantial, with a wide range of advantages, including cost reduction, fraud prevention, enhanced decision-making, and improved risk management. As banks navigate the AI landscape, they must prioritize data governance, talent acquisition, and continuous monitoring to ensure successful AI implementation. By harnessing the power of AI, banks can shape the future of banking and deliver superior services to their customers.

More articles by David Roldán Martínez:

The Intersection of Blockchain and APIs: Powering the Decentralized Future

Expert in APIs, AI, Digital Transformation, Business Solutions, and Open Economy related sectors. I bring a unique blend of technical and business expertise to the table. With a proven track record of delivering successful solutions for businesses of all sizes, I have helped organizations develop innovative business solutions by understanding their pain points and challenges and designing a roadmap to overcome them and drive growth.

My extensive experience in APIs at all levels has enabled me to work on a variety of complex projects, from building custom integrations to managing complex API ecosystems. I have a deep understanding of the intricacies of the API landscape.